Stop Guessing. Start Understanding the Market Cycle.

Crypto’s Macro Landscape: Trends, Risks, and Opportunities

“Far more money has been lost by investors preparing for corrections… than in the corrections themselves."

— Peter Lynch

Macr0verview March Edition

Well, well, well. What a month, right?

As someone who's been in this game since 2019, I've seen my fair share of ups and downs. But this month has been something else.

If you're reading this, chances are you're feeling the heat too.

You're probably checking your portfolio every hour, wondering what's going to happen next, and questioning every investment decision you've ever made.

I get it. It's natural to feel that way when the market is as volatile as it is right now.

Luckily for you, this edition of Macr0verview is arriving right on time - just before the storm hits.

Think of it as a guide to help you navigate the market during turbulent times. So take a moment to read it and get the clarity you need.

This is what you are gonna read:

Where are we in the market, according to key metrics (on-chain and market data)?

Is there genuine demand for Web3 and blockchain services in the industry?

A simple yet effective analysis. Exactly what you need in a time of noise and uncertainty.

The psychology of the market in motion | Data Analysis:

We are on the verge of two paths:

Breaking current support levels and officially entering a bear market (yes, entering, because this would only be the beginning).

Maintaining the bullish trend throughout most of the year, making March 2025 the month of opportunities (another month where you saw discounts but don’t took advantage of them).

To move beyond the obvious "the market can go up or down" analysis, my expectation is a false downside breakout of about 10%-20% (depending on the asset), followed by a hated bullish rally—one that shakes out weak hands before pushing the market higher.

This temporary dip wouldn’t break Bitcoin’s macro bullish trend, nor that of the broader crypto market, as it would find strong historical support both technically and on-chain.

Let’s dive in.

By the way, the following is extracted from an analysis I shared on LinkedIn, so if you want to know earlier about this kind of info I recommend you to give it a follow, and type your best email below

Every major Bitcoin cycle has had this one defining moment. And guess what? We’re in it right now.

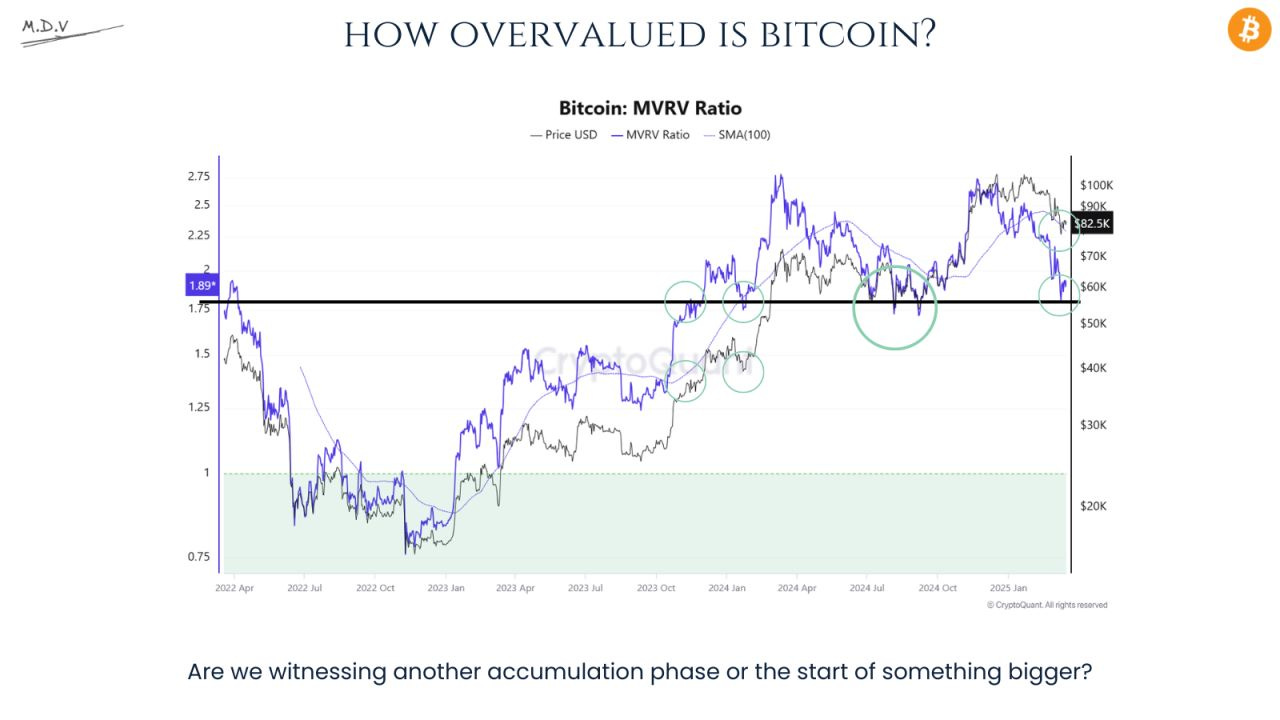

Why the MVRV ratio hitting ~1.89 is such a significant sign for Bitcoin.

What the 22% of investors in loss can tell you about the market’s true sentiment right now.

These two metrics are flashing signals that could mean we’re on the edge of something huge.

The MVRV Ratio is like a pulse check for Bitcoin’s market value.

• When it's high, it suggests the market is in an overbought phase—meaning Bitcoin might be overvalued.

• When it’s low, the opposite happens, signaling a potential buying opportunity or accumulation phase.

Right now is sitting near 1.89, and every time it’s hit this level in the past, we’ve seen major upward movement follow. This doesn’t guarantee the same will happen now, but the pattern is clear.

On the other hand, we have the percentage of investors who are at a loss. This isn’t just a statistic; it’s an indication of market sentiment.

Historically, when the percentage of loss has reached levels between 20% and 30% (currently at 22%), we've seen solid bottoms form or, more importantly, an imminent trend reversal.

Is the selling pressure over?

The short answer is we are at a moment where market narratives change.

The real question isn’t just what price will do—it’s how different market participants react to what happen next.

Right now, all the market’s realized losses are coming from Short-Term Holders—the newcomers who bought in the last 155 days and are now being shaken out by volatility.

Meanwhile, Long-Term Holders, the seasoned investors who have held for over 155 days, remain in profit and are the primary source of profit-taking.

But here’s where it gets interesting: Their moves are canceling each other out.

The profits taken by long-term holders are being almost entirely offset by the losses of short-term holders.

But wait, there’s more.

Over 2/3 of investors who bought BTC 5-7 years ago, exited their positions by December 2024.

In comparison, Investors who bought BTC 3-5 years ago are still holding strong. While their share of wealth has slightly declined—down 3% from its November 2024 peak—it remains at historically elevated levels.

That means most of them are not selling. They’ve weathered volatility, ignored short-term noise, and are betting on what’s ahead.

This tells us a few critical things:

Capital inflows are stagnating. There isn’t enough fresh demand coming in to absorb the selling pressure, which signals market weakness.

New buyers are capitulating. They’re selling at a loss, while long-term holders are still in control.

It’s a game of patience. The ones still holding from 2020-2022 are the ones defining the next leg of this market cycle. Will they continue to hold through potential shakeouts, or will the market force their hand?

That’s the question we’re about to see answered.

Still with me? Congratulations:

You already have a formed idea of what's happening and how it's happening.

You're about to see more key data on how the industry is doing in general.

If You Think This Market Is Dead, You’re Not Paying Attention:

💸 Institutions raised $4.7B, the highest since April 2022.

💸Tokenization is going parabolic: The demand for using or saving in dollars on-chain continues its macro uptrend.

Over $10.3 billion has been injected into the market in the last moth, led by:

USDC → +6.55% (+$3.696b)

USDT → +1.45%(+$2.066b)

Blackrock → BUIDL +247% (+$1.364b) y USDtB +1490% (+$1.342b)

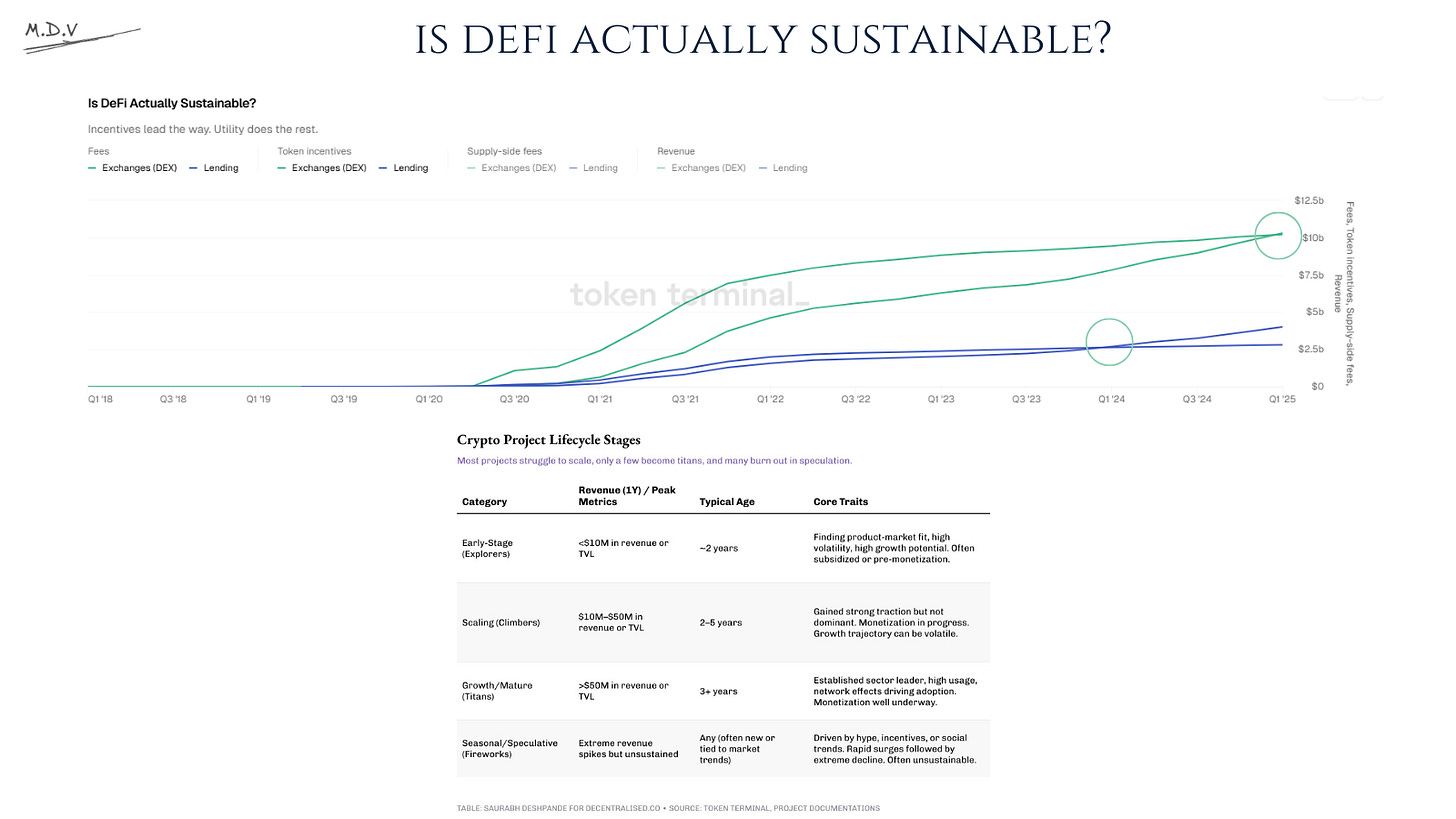

✅ For the first time in history, the Decentralized Exchange (DEX) sector has generated more fees than the incentives being paid, with $10.3B in fees surpassing $10.2B in incentives (link to full LinkedIn post)

✅ Demand for on-chain services has remained positive and is trending upward since 2023, having purified itself of speculative influences, and demonstrating the characteristics of a reliable ledger that can process and withstand significant volumes of transactions and economic value continuously, without succumbing to fatal errors.

So, what are the key takeaways from all this?

After analyzing multiple metrics, the conclusion is clear: this month’s correction has been strong enough to shake market psychology—even among the most respected analysts: CryptoQuant’s CEO thinks the bull market is over and that we’re on the brink of a bear market.

But here’s the truth: nothing has broken.

Key support levels are still holding, both in historical on-chain metrics and crucial price levels (especially for Bitcoin). The volatility has shifted sentiment, but the fundamentals haven’t shown signs of real capitulation yet.

Here’s how I’m approaching this moment of uncertainty:

Keeping liquidity ready in case of another 10%-20% drop to buy what I believe is the last dip.

Converting my lending market debt from stablecoins to ETH (yes, essentially opening a short to hedge against further downside). In other words, keeping my leveraged long positions delta neutral.

Sticking to my bullish strategy until I see clear invalidations across multiple on-chain metrics.

And that’s how I plan to sleep soundly in the middle of the storm.

P.S. I'm putting my money where my mouth is, and I'm sharing my public investment portfolio with you. If you're serious about investing and want to adapt some of my strategies or ask me any questions, I'm all ears.

P.P.S Let's get real for a second. The market can be unpredictable, but with the right information and analysis, you can make informed decisions that will help you come out on top. That's why I'm sharing my expertise with you, and that's why I want you to join me on this journey to financial freedom.

Disclaimer

The content provided is for educational and informational purposes only and should not be considered as investment advice in any form.

Readers are advised to approach this information cautiously and evaluate their unique circumstances before making investment decisions. The views and opinions expressed are subject to change without notice, and no liability is assumed for any loss or damage resulting from the use of this information.